Krsnaa Diagnostics: A unique business in a rapidly-growing industry.

Business Overview

Established in 2011 by Rajendra Mutha, Krsnaa Diagnostics is one of India's fastest-growing diagnostics service providers providing both pathology and radiology services across India. The Co. is a differentiated diagnostics service provider focusing on the public-private partnership (PPP) segment. As of June 2021, Krsnaa Diagnostics operated 1,823 diagnostic centres offering radiology and pathology services in 14 states across India.

Understanding the Industry

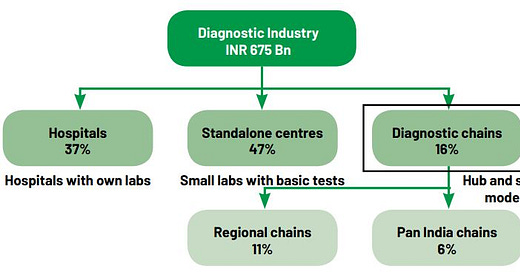

The Indian diagnostic industry is estimated to be approx. Rs.67,000 Cr as of 2021 and is expected to grow at a CAGR of ~15% for the next couple of years to reach a value of ~Rs.90,000 Cr by 2023.

The Indian diagnostic industry can be divided into 2 segments: Pathology and Radiology. ~58% of revenues are derived from the pathology segment and ~42% of the revenues are derived from the radiology segment. In India, the market share is mostly dominated by standalone centres(unorganised players) and hospitals with in-house diagnostics departments. Organised diagnostics chains make up only a small part of the market with ~20% market share as compared to around 40-50% market share in developed countries like the United States. The diagnostics sector across the world and especially in India is going through a rapid change in the market structure because of the consolidation of market share from unorganised players to organised players. Using technology, logistics and private equity capital infusions, the organised players have been able to rapidly expand their operations and take market share away from the small and unorganised players.

Of late, due to an increased focus on healthcare and a rise in government spending for the democratization of healthcare, a new business model called the public-private partnership (PPP) is gaining prominence.

Understanding the PPP model

Due to the rise in healthcare costs of private players and the lack of public health infrastructure, there is a huge potential for the government to join hands with the private players to increase the affordability, build accessible healthcare infrastructure and provide quality healthcare across the country.

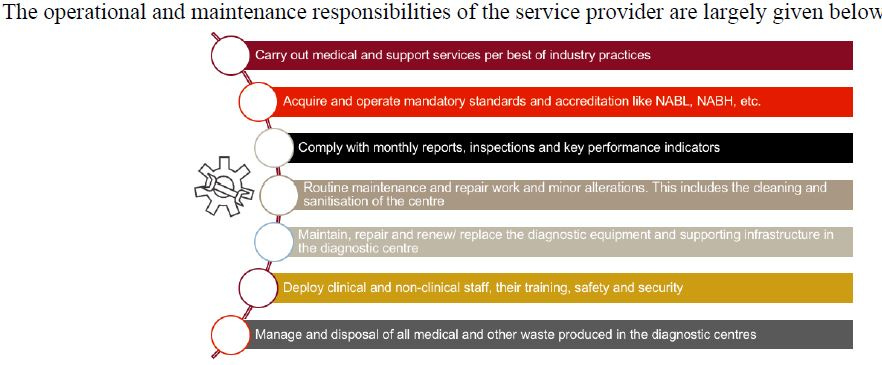

Under the PPP model, the private player is involved in making greenfield/brownfield diagnostic centres across various hospitals and in some cases is also responsible for setting up collection points in sub-centres, primary health centres, community health centres, etc. The physical premise for setting up the infrastructure is provided by the government authority and the private player is responsible for the operation and maintenance of the facility.

Under the PPP model, the services are provided free of cost to the government beneficiaries and the cost is reimbursed by the government authority on a timely basis. The private beneficiaries are usually charged as per the rates quoted by the service provider.

Investment Thesis/Growth Drivers for Krsnaa Diagnostics

Dominance in the PPP segment-

Unlike other diagnostic chains and organised players, Krsnaa Diagnostics primarily focuses on the PPP segment with ~78% of all related government tenders being granted to the company. The Co. has a presence in 14 states across the country under the PPP model as compared to an average presence in 3-4 states for other players. The Co. has a dedicated team to identify and acquire government tenders based on the company's requirements and suitability.

Pricing and Margin expansion-

When compared to other top organised players, Krsnaa offers ~45-50% lower prices in both the pathology and the radiology segments.

Despite offering significantly lower prices, the company has relatively strong/healthy operating margins because of its unique business model which reduces operational expenses like rent, referral fees, etc. In its radiology segment, the company can process large volumes of X-rays, CT scans and MRI scans through its centralised teleradiology reporting hubs. This removes the requirement for a radiologist in every facility allowing the company to rapidly expand to tier-2 & tier-3 cities and villages.

Revenue Visibility and Pricing power-

Under the PPP model, the company typically has long-term contracts of 5-10 years which also includes an extension clause based on a mutual agreement. This gives Krsnaa Diagnostics a competitive advantage to consistently grow its revenues from the volume generated through government beneficiaries.

Some of the PPP contracts also have a price escalation clause that allows the company to revise and increase the rates on their services periodically and since the company currently offers ~50% lower prices, it has a lot of room to increase its prices when appropriate.

Rapid Expansion across the country-

Krsnaa Diagnostics is the fastest-growing diagnostic chain in the country with a revenue growth rate of 58% CAGR from FY18 to FY21.

Despite a very high growth rate in recent years, the company has much headroom to grow further. The company has been rapidly expanding its operations with newer PPP contracts in Punjab, Mumbai and Himachal Pradesh in both radiology and pathology segments with a total initial CAPEX of ~Rs.39 Cr. Further, The Co. is also looking to enhance its capabilities in specialized diagnostics like molecular & genomics.

Risks

Dependency on the Government for reimbursement-

The Co. derives around 68% of its revenues through its PPP contracts which makes the company rely on timely reimbursement from the government and any delays in payment from the government authorities will cause significant trouble managing the company's working capital requirements.

Increasing Capital infusion-

Because of the visible low penetration level of healthcare in India, a lot of private equity investors and entrepreneurs have entered the industry in an attempt to capture the growing market in India. A lot of new companies have raised money from Private Equity firms and have started offering services at unsustainably low prices by burning cash to take the market share from incumbent and unorganized players. This increased inflow of capital has increased the competition for the company.

Financial Snapshot & Valuations

The Co. is currently trading at ~10x TTM earnings(although a large part of this earnings comes from a non-recurring source) and <1x EV/EBITDA as compared to an industry average of 85x earnings and ~45 EV/EBITDA for other larger and more established players in the industry. On a relative basis, the company trades at a huge discount to its peers but is also less established and is yet to scale its operations PAN India.